In the sprawling tapestry of China's consumer landscape, a quiet yet profound revolution is unfolding far from the glare of international spotlights and metropolitan buzz. The narrative of fashion and aesthetic consumption is being rewritten not in the chic boutiques of Shanghai or the avant-garde showrooms of Beijing, but in the humbler, yet dynamically evolving streets of third and fourth-tier cities. This is the story of the "small-town youth" – a demographic cohort whose rising economic power, digital nativity, and burgeoning taste for refinement are catalyzing a significant aesthetic upgrade, reshaping market strategies and brand perceptions across the nation.

Gone are the days when fashion was the exclusive domain of elite urbanites. Today, young consumers in cities like Yantai, Zhuzhou, or Baoding are demonstrating an increasingly sophisticated and discerning eye for style. Their preferences are maturing, moving beyond mere functionality or overt branding toward a more nuanced appreciation for design, quality, and self-expression. This shift is underpinned by greater disposable incomes, the pervasive influence of digital platforms, and a growing desire to forge distinct personal identities that resonate with both local pride and global trends.

The digital realm has been the great equalizer and primary catalyst for this aesthetic awakening. Through platforms like Douyin, Xiaohongshu, and Taobao Live, young consumers in smaller cities are exposed to a constant stream of global fashion trends, styling tips, and product reviews. They are no longer passive recipients of trickle-down trends from first-tier cities; instead, they are active participants in a national, even global, conversation about style. They follow influencers who speak their language, literally and culturally, and they use these platforms not just for discovery but for validation and community building. This digital immersion has dramatically accelerated their fashion education and raised their expectations.

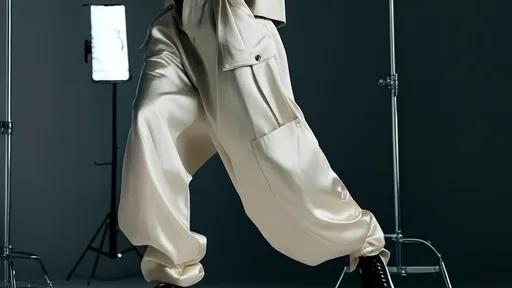

This newfound discernment manifests in several key consumption preferences. There is a marked gravitation towards minimalist and quality-focused brands. Unlike the previous generation's often ostentatious display of logos, today's small-town youth often seek understated elegance, valuing good fabrics, clean cuts, and timeless design. They are willing to invest in pieces that offer longevity and versatility, signaling a move away from fast fashion towards what might be termed "rational consumption." Domestic brands are particularly adept at capturing this sentiment, offering high-quality products with designs that often blend modern aesthetics with subtle Chinese cultural elements, striking a powerful chord with this audience.

Furthermore, the concept of seasonless fashion and a curated personal style are gaining traction. Their purchases are increasingly deliberate, aimed at building a cohesive wardrobe rather than chasing every fleeting trend. This is a sophisticated approach to consumption, reflecting a deeper understanding of personal branding and value. They meticulously research before buying, comparing materials, reading countless user-generated reviews, and watching haul videos to gauge the real-life look and feel of a garment. This is a savvy, informed consumer who cannot be easily won over by marketing hype alone.

The physical retail environment in these cities is also transforming to meet these upgraded expectations. While e-commerce reigns supreme, the demand for experiential shopping is growing. Malls and boutiques are evolving from mere transactional spaces into social and leisure destinations. They feature aesthetically pleasing interiors, coffee shops, exhibition spaces, and interactive installations, creating an environment where shopping is an event, an experience to be shared on social media. This blend of digital discovery and physical experience is crucial for brand building and customer loyalty in these markets.

Another fascinating dimension is the reinterpretation of global trends through a local lens. Small-town youth adeptly mix and match. A luxury handbag might be paired with a popular domestic sneaker brand; a international designer jacket could be worn with trousers from a local online retailer they discovered on Xiaohongshu. This style syncretism is not a lack of taste but its opposite—a confident assertion of their unique identity, navigating global influences without surrendering their local cultural context. It's a fashion statement that says, "I am part of the world, but I am also uniquely me."

This demographic's spending power is formidable and cannot be ignored. While individual disposable income might be lower than in megacities, lower living costs translate into significant discretionary spending potential. Furthermore, reduced pressure from skyrocketing mortgages and rents frees up cash that their counterparts in Shanghai or Shenzhen must allocate elsewhere. Brands that dismiss these markets as "secondary" are overlooking a vast, eager, and increasingly affluent customer base that is driving a substantial portion of the country's consumption growth.

In conclusion, the aesthetic upgrade among youth in China's smaller cities represents one of the most significant consumer trends of the decade. It is a movement driven by digital connectivity, economic empowerment, and a powerful desire for self-definition. These consumers are discerning, value-driven, and style-conscious, blending global awareness with local sensibilities to create a vibrant and distinct fashion ecosystem. For brands, both domestic and international, understanding and authentically engaging with this demographic— respecting their sophistication, catering to their curated tastes, and connecting with their unique cultural perspective—is no longer an option but a critical imperative for success in the new Chinese market. The future of Chinese consumption is being shaped, in no small part, in its small towns.

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025

By /Aug 21, 2025